The Best Guide To Tidepoint Construction Group

Wiki Article

Tidepoint Construction Group Fundamentals Explained

So, by making your residence more protected, you can really earn a profit. The inside of your home can obtain obsoleted if you do not make adjustments as well as upgrade it every once in a while. Interior decoration styles are always changing and what was stylish 5 years earlier may look ludicrous now - https://penzu.com/public/4ec15407.

You might also feel burnt out after checking out the same setup for many years, so some low-budget adjustments are always welcome to provide you a little bit of change. You pick to integrate some traditional aspects that will certainly proceed to appear present and trendy throughout time. Do not fret that these improvements will certainly be pricey.

Pro, Tip Takeaway: If you feel that your home is as well little, you can renovate your cellar to enhance the quantity of room. You can use this as an extra room for your family members or you can lease it bent on create additional revenue. You can maximize it by working with professionals that supply renovating solutions.

Our team of experts enjoys each job they do to make sure you are completely pleased with the results. They have the expertise and experience to finish tasks within the set timelines, whether dealing with brand-new building and construction or repair on an existing residential or commercial property. We really hope with this knowledge you're currently familiar with all the benefits of renovating your house.

Facts About Tidepoint Construction Group Revealed

Home restorations can boost the way your house looks, however the benefits are moreover. When you deal with a reputable improvement company, they can help you improve performance, function, way of living, as well as worth. Hilma Building And Construction in Edmonton offers full remodelling services. Keep reading to discover the advantages of residence remodellings.

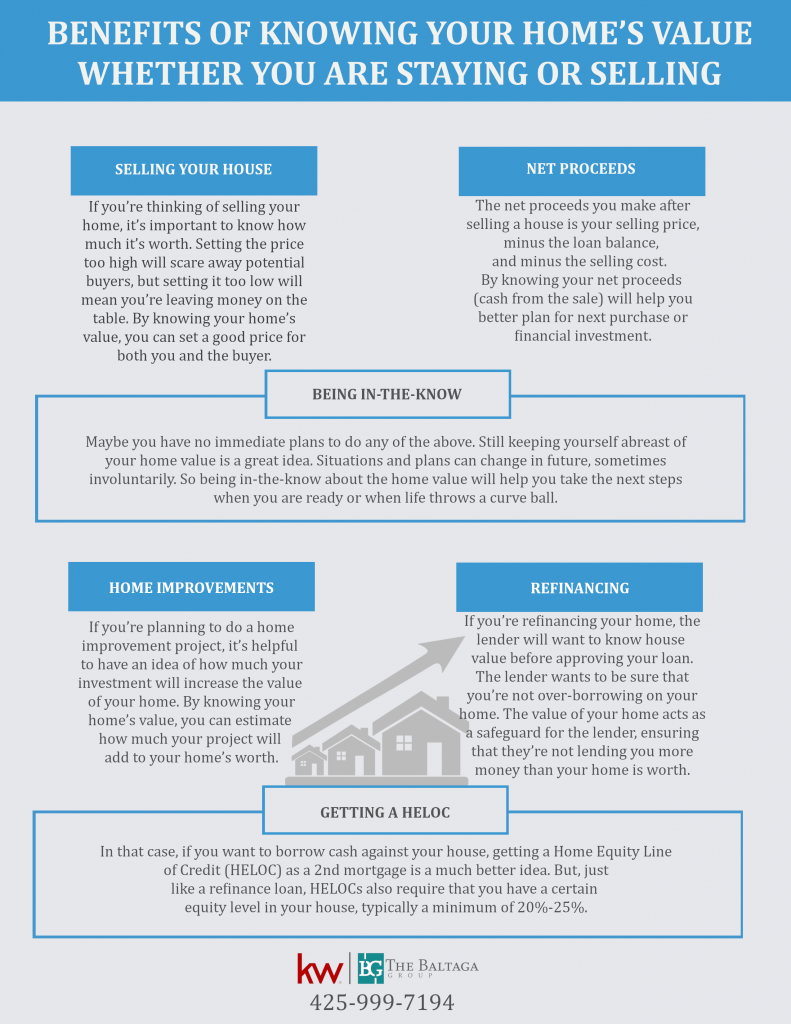

Regular home maintenance and also fixings are needed to keep your residential property worth. A residence improvement can aid you maintain and increase that worth. Using a house equity finance to make home improvements comes with a couple of benefits that other uses don't.

This isn't the instance if you make use of those funds to consolidate financial debt or cover another large expenditure. Similar to any type of financing choice, you intend to have a clear photo of why you're borrowing (the objective) and also just how you will certainly pay it back. Below's how to best use a home equity finance to take on remodeling projects, along with important benefits and drawbacks to consider.

Examine This Report about Tidepoint Construction Group

That set rates of interest means your monthly settlement will certainly be constant over the term of your lending. In a climbing rates of interest environment, it might be less complicated to factor a set repayment right into your budget. The various other option when it comes to touching your residence's equity is a residence equity line of credit score, or HELOC.

You'll just pay interest on the cash money you've borrowed throughout the draw period, but, usually at a variable price. That means your month-to-month payment undergoes transform as prices increase. Both home equity loans and HELOCs utilize your residence as security to secure the car loan. If you can't manage your month-to-month repayments, you could shed your residence-- this is the greatest threat when obtaining with either type of car loan.

Think about not just what you want today, but what will interest future purchasers due to the fact that the tasks you pick will affect the resale value of your home (Home remodeling company near me). Collaborate with an accountant to see to it your passion is correctly subtracted from your taxes, as it can conserve you tens of thousands of bucks over the life of the funding.

There are great reasons to warrant taking out a residence equity car loan to remodel or remodel your home, not the least of which is taking pleasure in the enhancements you have actually made to your essential financial investment. There are useful factors, and also benefits, that warrant tapping right into your house equity. As stated previously, the passion on your home equity financing is tax obligation insurance deductible, supplied that you utilize the cash to "get, build or considerably enhance your home," according to the internal revenue service.

More hintsThe Of Tidepoint Construction Group

Existing home equity rates are as high as 8. 00%, however personal finances are at 10., such as the one we're in today.

As discussed above, it matters what kind of remodelling projects you take on, as specific residence enhancements offer a greater return on investment than others. A minor kitchen area remodel will certainly recover 86% of its value when you offer a residence contrasted with 52% for a wood deck enhancement, according to 2023 data from Remodeling magazine that evaluates the expense of renovating projects.

While home values have skyrocketed over the last 2 years, if home costs drop for any type of factor in your location, your financial investment in enhancements will not have actually increased your home's worth. When you finish up owing more on your home loan than what your residence is actually worth, it's called negative equity or being "undersea" on your mortgage.

A HELOC is usually better when you desire extra flexibility with your lending. With a fixed-interest rate you do not require to stress over your payments increasing or paying extra in passion gradually. Your month-to-month settlement will certainly always coincide, regardless of what's occurring in the economic climate. All of the cash from the funding is dispersed to you upfront in one repayment, so you have accessibility to all of your funds quickly.

Report this wiki page